nebraska tax withholding calculator

Form W-3N Due Date. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Calculate Nebraska State Income Tax Manually.

. If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you. State copies of 2021 Forms W. State Date State Nebraska.

Multiply the number of Allowances by 2080 Apply the taxable income computed in step 5 to the following tables to determine the Nebraska tax withholding. Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska paycheck calculator. Your W-4 calculator checklist.

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. And step by step guide there. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

It is not a substitute for the advice of an accountant or other tax professional. The value of the Nebraska allowance is. State Date State Nebraska.

Launch Free Calculator OR See Nebraska tax rates Federal Payroll Taxes. Five to 10 minutes to complete all the questions. Multiply the number of Allowances by 1960 Apply the taxable income computed in step 5 to the following tables to determine the Nebraska tax withholding.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. Nebraska Paycheck Calculator - SmartAsset SmartAssets Nebraska paycheck calculator shows your hourly and salary income after federal state and local taxes. Nebraska collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Payroll check calculator is updated for payroll year 2022 and new W4. By the quantity of cash being held back the employees have the ability to claim tax returns credit history. All you have to do is input wage and W-4 information for each employee into the calculator and it will do the rest.

Current paycheck stubs for all jobs. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Like the Federal Income Tax Nebraskas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Income Tax Withholding Reminders for All Nebraska Employers Circular EN. The calculator can figure out all of the federal and Nebraska state payroll taxes for you and your employees. Calculate your state income tax step by step 6.

The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022. Use tab to go to the next focusable element. If you like to calcualte state tax withholdings manually you can refer to the Nebraska tax tables.

August 5 2021 by Kevin E. All tables within the Circular EN have changed and should be used for wages pensions and annuities and gambling winnings paid on or after January 1 2022. The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State Income Tax Rates and Thresholds in 2022.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. The Nebraska tax calculator is updated for the 202223 tax year. Paycheck Calculator is a great payroll calculation tool that can be used to compare net pay amounts after payroll taxes in different states.

The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NES. Tax Withholding Table for Single or Head of Household Tax Withholding Table for Married If the employee is eligible for lower withholding than required by Nebraska LB223 proceed to step 8. The Nebraska Form W-4N is completed by the employee to determine the number of allowances that the employer uses in conjunction with the Nebraska Circular EN to calculate the Nebraska income tax withholding.

Check the 2020 Nebraska state tax rate and the rules to calculate state income tax 5. Nebraska Withholding Tax Federal. Figure out which withholdings work best for you with our W-4 tax withholding calculator.

Nebraskas maximum marginal income tax rate is the 1st highest in the United States ranking directly. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. 691 rows In 2012 Nebraska cut income tax rates across the board and.

Enter your info to see your take home pay. If you need to create the paychecks and paystubs by entering the federal and state tax amount you can refer to this article How to Generate After the Fact Paychecks with Stubs. Switch to Nebraska hourly calculator.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Nebraska residents only. Read listed below to learn more about it in addition to. The Nebraska tax tables here contain the various elements that are used in the Nebraska Tax Calculators Nebraska Salary Calculators and Nebraska Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers.

The Nebraska income tax calculator is designed to provide a salary example with salary deductions made in Nebraska. Change state Check Date General Gross Pay Gross Pay Method. Tax Withholding Table for Single or Head of Household Tax Withholding Table for Married If the employee is eligible for lower withholding than required by Nebraska LB223 proceed to step 8.

19 in Nebraska and Alabama 21 in Puerto Rico Identity verification is required. Nebraska Paycheck and Payroll Calculator Free Paycheck Calculator to calculate net amount and payroll taxes from a gross paycheck amount. Nebraska tax withholding calculator Nebraska Withholding Tax.

Nebraska Withholding Tax Federal Withholding Tables 2021 is the process called for by the United States federal government in which companies deduct tax obligations from their employees pay-roll.

How To Do Payroll In Excel In 7 Steps Free Template

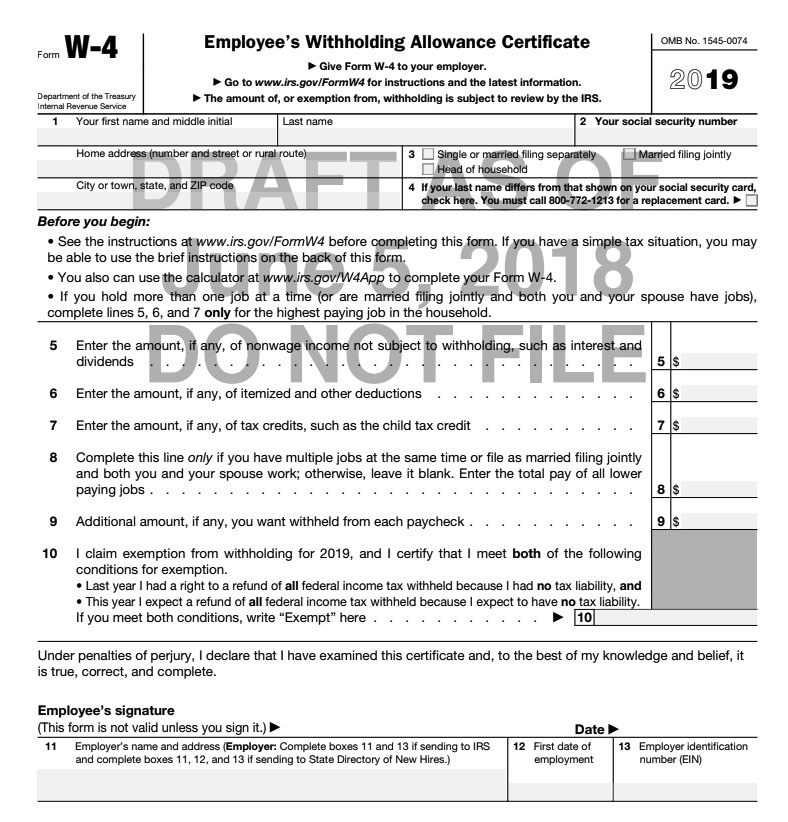

State W 4 Form Detailed Withholding Forms By State Chart

Tax Withholding Calculator For Employers Irs Taxes Federal Income Tax Tax

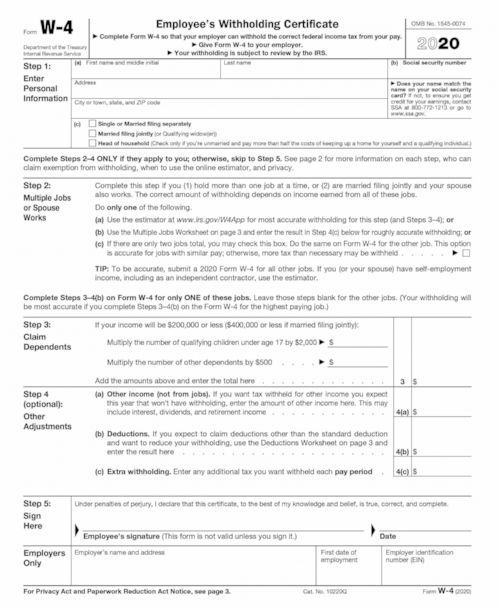

Bien Remplir Son W 4 Gaelle In Los Angeles Remplir

Nr4 Non Resident Tax Withholding Remitting

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

750 Tax Pictures Download Free Images On Unsplash

State W 4 Form Detailed Withholding Forms By State Chart

Sales Tax Withholding Rates How To Deduct Sales Tax With Practical Examples Fbr 2021 Youtube

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Accounting For Agriculture Federal Withholding After New Tax Bill Unl Beef

Everything You Need To Know About The New W 4 Tax Form Gma

Iced Out Hip Hop Jewelry Google Search Hip Hop Jewelry Rapper Jewelry Popular Jewelry

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age