amazon flex taxes canada

The standard deduction is against your taxable income on your 1040. You can find your 1099-NEC in Amazon Tax Central.

Turbotax Canada Uber Partner Webinar For The 2017 Tax Year Youtube

If your products are located outside of Canada before you ship them to a Canadian address or to our fulfilment centre.

. If your business is located in Quebec and your sales tax rate is 14975 rate may vary and you sell an item with a total price of 20 with a 15 referral fee fee may vary based on product type we will collect and remit 045 tax on the 300 referral fee to comply with federal and. 12 tax write offs for Amazon Flex drivers. In this type of situation the person can combine their multiple jobs into one general category such as Delivery.

Amazon Drive Cloud storage from Amazon. Schedule C will have your business income and expenses. Turn on Location Settings.

Sign out of the Amazon Flex app. Who Pays The Most Tax In Canada. Book Depository Books With Free Delivery Worldwide.

You can plan your week by reserving blocks in advance or picking them each day based on your availability. The tax calculation service fee will be 29 of the tax amount calculated on your products and is non-refundable. The amount of tax and National Insurance youll pay will depend on how much money is left over after deducting your flex expenses tax allowances and reliefs.

There are other situations and this may be what you have where a self-employed person or independent contractor has multiple jobs but the jobs are very similar. If you sell products in Canada you are responsible for paying any applicable taxes destination duties and customs clearance fees before your product can be sold to Canadian residents or stored in an Amazon fulfilment centre. Your sales tax report contains all the tax calculation details jurisdiction rate ship tofrom etc used to make a tax calculation on every item sold in an order.

Driving for Amazon flex can be a good way to earn supplemental income. The 153 self employed SE Tax is to pay both the employer part and employee. This report is useful when you are filing your sales taxes with.

How to Calculate Your Tax. Your 1099-NEC isnt the only tax form youll use to file. Class 2 National Insurance is paid as a set weekly.

Amazon flex business code. As an independent contractor. To make sure you do this right just look through your bank statements and add up your direct deposits from Amazon Flex.

But instead of it taking you four hours to make all of your deliveries you managed to make them in three hours. Youre going to get a 1099 and fill out a Schedule C for this. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

Once youve downloaded the app set up your account and passed a background check you can look for delivery opportunities that are convenient for you. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. With every offer youll see your expected earnings and how long your block is likely.

If you dont want to wait for your 1099 you have two options. Increase Your Earnings. Choose the blocks that fit your schedule then get back to living your life.

You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. Legislation was enacted in British Columbia BC Canada that requires non-residents to apply Provincial Sales Tax BC PST on specific cross-border digital services supplied to BC customers who utilize the service for their own purposes eg are not resellers. Knowing your tax write offs can be a good way to keep that income in your pocket.

Amazon Web Services Scalable Cloud Computing Services. Amazon Advertising Find attract and engage customers. The final number will be the taxable income which will go on your 1040.

Amazon Music Stream millions of songs. With Amazon Flex you work only when you want to. How do you get your Amazon Flex 1099 tax form.

Gig Economy Masters Course. Report Inappropriate Content. With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes.

Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone. The first option is to enter your income in your tax software as income you didnt receive a. The correct business code is 492000 Couriers messengers.

The following examples illustrate how Canadian sales tax may be calculated on your selling fees. We are actively recruiting in. Amazon will not withhold taxes on the earnings of Canadian tax residents.

Select Sign in with Amazon. Open the Amazon Flex app to search for available delivery blocks in your area. Amazon Flex quartly tax payments.

Such as a delivery driver for Amazon DoorDash Uber and Lyft. Internal Revenue Service regulations require Amazon to post your 1099 by January 31st. This new legislation takes effect on April 1 2021.

Disable or uninstall any app that changes the lighting on your phone based on the time of day. Income tax starts at 20 on all your income not just from amazon over 12500 and 40 over 50000. Fill out your Schedule C.

Online shopping for Tax Central from a great selection at Software Store. A family earning more than 150000 in taxable income pay 28 percent moreIt is 8 percent of all taxes but 22 percent of all earned incomeTaxes on total income are less than 8 percent39 dollars are paid by families in the top 10 percentThe government earns 33 percent of all tax revenue from 6 percent of all taxesTaxes. Tap Forgot password and follow the instructions to receive assistance.

Amazon Flex is a program where independent contractors called delivery partners deliver Amazon orders. The mileage deduction is one of those expenses. And Amazon pays you 25 an hour so 100 for the whole block.

Unfortunately youll still have to report your income to the IRS even without a 1099. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. So you make 100 for 3 hours of work increasing your rate from 20 an hour to around 33 an hour.

Louis MO Boston MA Salt Lake City UT. First reserve a block.

Tax Tips For Couriers On The Skip Network Youtube

How To Make Money On Amazon In Canada 12 Practical Ways 2022

Level 3 Face Mask Disposable Medical Mask In Canada United Canada

Discovery Canada Streaming Service Launches Kutko Canada

Canada Rules Amazon Flex Drivers Are Employees And Can Unionize Flex Drivers Can Do Way Better R Amazonflexdrivers

E Reader Market Size To Reach Usd 12 33 Billion By The End Of 2024 Cagr 6 1 Market Research Future Market Research Research Report Readers

Stacktv Now Available On Rogers Ignite Tv And Ignite Smartstream

Heartcheck Personal Ecg Heart Monitor Health Canada Fda Cleared 3 Free Ecg Reviews With Each Order 37 50 Us In Savings No Subscription Fees Best Buy Canada

Pre Order Galaxy Book2 Pro Book2 Pro 360 Samsung Canada

1 1 Cu Ft Low Profile Over The Range Microwave With 550cfm Me11a7710ds Ac Samsung Canada

Canada Rules Amazon Flex Drivers Are Employees And Can Unionize Flex Drivers Can Do Way Better R Amazonflexdrivers

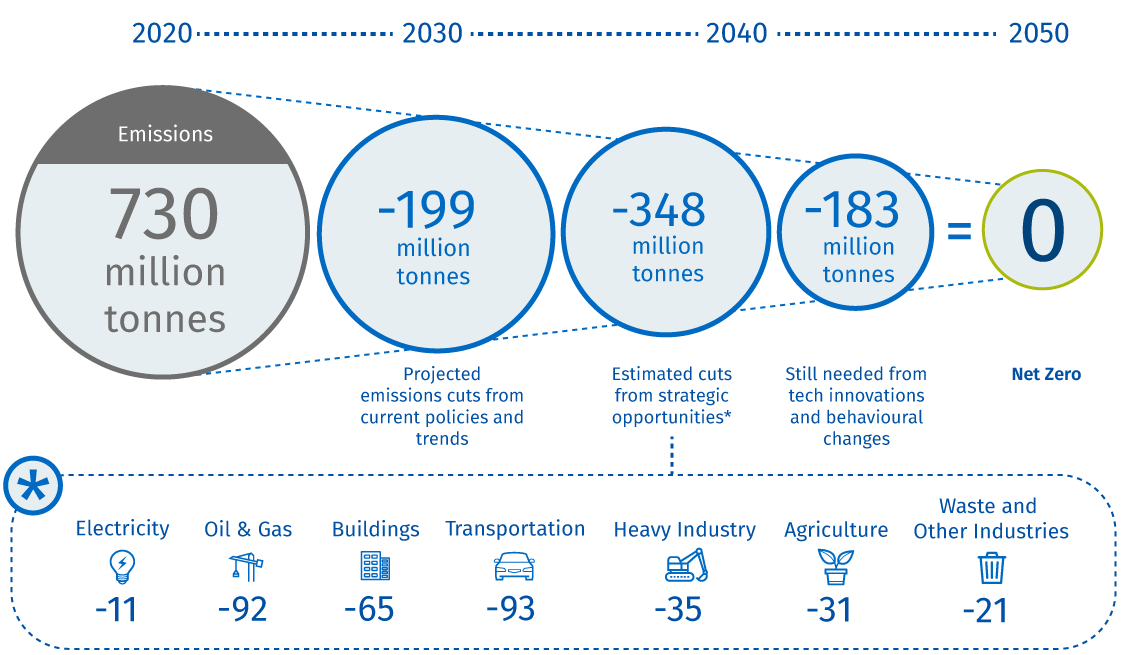

The 2 Trillion Transition Canada S Road To Net Zero

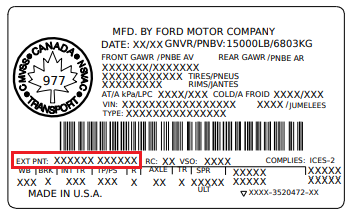

Where Can I Purchase Touch Up Paint

Wahl Canada Refresh All Body Massager Handheld Massager Variable Intensity To Relieve Pain In The Back Neck Leg Foot Shoulders And Muscles Model 4189 Amazon Ca Health Personal Care