texas estate tax calculator

Compare that to the national. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Calculate Your Tax Savings With Limited Amount Of Effort Using Bonus Depreciation Calculator Federal Income Tax Tax Reduction Income Tax Saving

King County collects the highest property tax in Texas levying an average of 506600 156 of.

. Texas has a 625 statewide sales tax rate but also. The exact property tax levied depends on the county in Texas the property is located in. Calculator is designed for simple accounts.

Texas Property Tax Calculator to calculate the property tax for your home or investment asset. While the state does not appraise property values set property tax rates or collect property taxes they set the operating rules for political subdivisions imposing and administering them. Enter your Over 65 freeze amount.

Ad Look Up Any Address in Texas for a Records Report. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. It is sometimes referred to as a death tax Although states may impose their own.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. See Results in Minutes. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Property Value Calculate 2022 Johnson County. County and School Equalization 2023 Est. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Tax Rate City ISD Special. Our calculator has recently been updated to include both the latest Federal Tax Rates.

Property Tax Search Pay. Calculate 2022 Johnson County. Enter your Over 65 freeze year.

Find Records For Any City In Any State By Visiting Our Official Website Today. For comparison the median home value in Austin County is. Counties in Texas collect an average of 181 of a propertys assesed fair market.

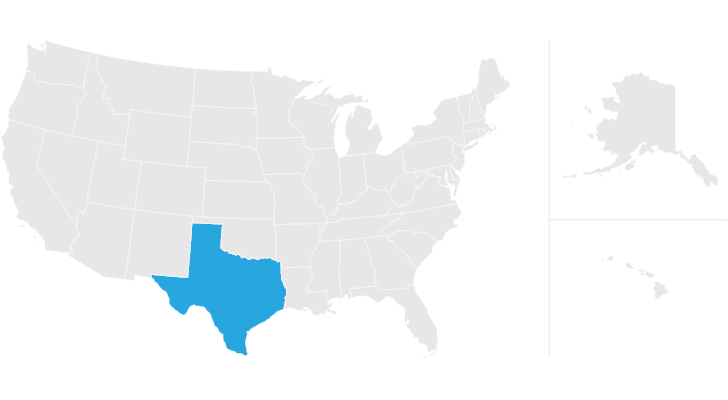

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Property taxes in Texas are the seventh-highest in the US as the average effective property tax rate in the Lone Star State is 169. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

For comparison the median home value in Dallas County is. You are able to use our Texas State Tax Calculator to calculate your total tax costs in the tax year 202223. English United States español Estados Unidos MENU.

For comparison the median home value in Texas is 12580000. For comparison the median home value in Bexar County is. Property tax is calculated based on your home value and the.

For comparison the median home value in El Paso County is. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. Texas Property Tax Calculator.

Texas Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Sell Your House Fast For Cash Dynamic Estates We Buy Houses Sell Your House Fast Selling Your House

Southfork Ranch Dallas Southfork Ranch Dallas Tv American Mansions

Texas Estate Tax Everything You Need To Know Smartasset

Derek Fisher A Former Laker Point Guard Lists His Home In Hidden Hills For 6 195 Million Long Valley Selling House Home Financing

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

1426 E Odneal Street Backyard New Homes Open Floor Plan

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is There A Federal Inheritance Tax Legalzoom

Don T Die In Nebraska How The County Inheritance Tax Works

A Guide To Estate Taxes Mass Gov

I M Looking For A Buyer For My Listing At 2857 Joshua St San Angelo Tx Please Contact Me For Details Homebuyer Www Ho Home Buying Texas Homes House Styles

Congressman Mulls Risky Relief For Real Estate Real Estate Trends Distressed Property Real Estate Investing

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Alimony Calculated In South Carolina Child Support Laws Calculate Ch Child Support C Child Support Quotes Child Support Laws Child Support Payments